MyHealth360 provides a medical plan with access to prescription drug coverage. If eligible, you can select one of four coverage levels: Employee Only, Employee + Child(ren), Employee + Spouse/Domestic Partner or Family.

The Piedmont PRN Plan is designed to meet your physical and financial needs.

MyHealth360 Medical Plan Coverage Summary

Summary of Benefits and Coverage (SBC)

Medicare navigation support will be available through SmartConnect at no cost to you. All Medicare-eligible team members, spouses/domestic partners and dependents who are interested in enrolling in Medicare, Medicare Supplements or Medicare Advantage plans can receive assistance with plan comparisons, selection and enrollment. Additional resources include ongoing support for plan and claims questions, as well as access to educational materials, webinars and licensed agents. Learn more.

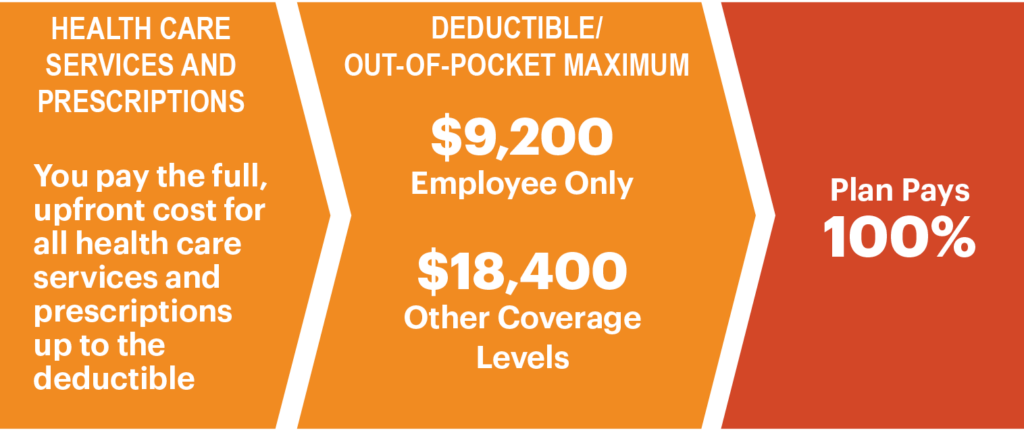

The level of benefits you will receive depends on where you choose to receive care. In the Piedmont PRN Plan, you can receive care from in-network providers, but you will not be covered if you choose to see out-of-network providers. You pay for the full cost of health care services, including prescription drugs, until you reach the in-network deductible/out-of-pocket maximum.

To locate a provider, use one of the following options:

Note: Not all physician offices located on Piedmont campuses are in the Piedmont Clinic.

When you select an out-of-network provider, you will incur the highest out-of-pocket expenses. Providers and facilities are those not included in the Cigna Open Access Plus Network.

This example shows coverage using in-network providers.

Fertility, pregnancy and postpartum benefits will be available through Progyny beginning Jan. 1, 2025. MyHealth360 plan members can receive up to two SmartCycles with coverage for IVF, IUI and fertility preservation through Progyny providers. This includes medical services and medication on each treatment journey. You also receive unlimited guidance and support from a dedicated patient care advocate who can help you navigate a large network of fertility experts. Progyny also offers menopause and midlife care. For more information, see the benefits overview and Progyny Member Guide. You can also call 833-233-0722 or visit progyny.com/benefits.

Partnering with Progyny closely aligns with our systemwide goal of improving and advancing maternal fetal health in Georgia and beyond.

Prescription drug coverage administered directly be Express Scripts is provided automatically when you enroll in the Piedmont PRN Plan. If your medication is not on the no-cost generic preventive medications listing, you will you pay the full cost until you reach your deductible/out-of-pocket maximum. Any prescription drug costs you pay for on your own will contribute towards your annual deductible/out-of-pocket maximum.

Please note: Weight loss drugs are not covered under any MyHealth360 medical plan, and all fertility medications are managed through Progyny rather than Express Scripts.

When it comes to prescriptions, there are five easy guidelines to follow:

Prescription Drug Formulary Summary

Preferred Prescription Drug Formulary and Exclusions List

List of No-Cost Generic Medications

How the prescription drug deductible works:

We offer life-changing specialty pharmacy services designed to simplify every aspect of your care. From obtaining financial assistance, to navigating through your insurance benefits, coordinating with providers, and managing refills, Piedmont Specialty Pharmacy patient liaisons are ready to help you and your family.

Our team can answer and address insurance-related questions and conduct prior authorizations for complex, rare and chronic medical conditions that require specialized medication therapy.

For more information, visit Piedmont Direct Pharmacy, call 833-551-2024 (Monday through Friday, 8am – 4:30pm) or email piedmontdirect@piedmont.org.

Eligibility

Children include your or your spouse’s/domestic partner’s natural children, legally‑adopted children, legal wards and stepchildren.

* Piedmont benefits may be considered secondary. Please refer to your Summary Plan Description to determine which plan is primary.

For non-emergency care, get a virtual visit on your computer or smartphone from anywhere. You have 24/7 access to board-certified doctors for a copay. Also, get same-day care for minor injury or illness at all Piedmont-branded urgent care centers for a copay. Most locations are open seven days a week with extended hours.

Interested in enrolling (no current PRN Medical coverage)

If you have never participated in the Piedmont PRN Medical plan and are interested in enrolling, please send an email to PRNMedicalBenefits@piedmont.org. You must include your employee ID, name, and a list of any spouse/domestic partner and/or dependent child(ren) you would like to enroll. If covering any dependents, you will need to include their full name, dates of birth, Social Security numbers and address (if different from your own). Failure to provide all details may result in delayed coverage.

Once enrollment details are established, you will receive a welcome email from Lively, where you can make your medical elections and establish monthly premium payments.

Already enrolled and want to waive coverage

As an employee currently enrolled in the PRN Medical Plan, you are free to drop coverage at any time. If you would like your PRN Medical Plan to terminate prior to Jan. 1, 2026, please send an email to PRNMedicalBenefits@piedmont.org. Your coverage will end on the last day of the month through which you have paid; premiums will not be prorated if you cancel coverage before the last day of the month.

If you wish for your PRN Medical Plan to end beyond Jan. 1, 2026, you may choose to waive coverage with Lively by TBD.

Already enrolled and want to add/remove dependent(s)

You may add or remove dependent coverage if you experience a qualifying life event (e.g., marriage, divorce, or a loss of coverage). To initiate a qualifying life event, please send an email to PRNMedicalBenefits@piedmont.org outlining the details of your request.

When you enroll in direct bill through Piedmont

Premium payments can be made in a variety of ways. When you enroll in direct bill, you will receive premium payment coupons with the details of the premiums owed, due date, and methods of payment. These include:

Paying your premiums and when payment is due

You will be billed on a monthly basis by a third-party administrator, Lively, and your payment must be received by the due date indicated for initial coverage to be activated and to continue your eligibility of coverage.

Missing premium payments and termination of coverage

You have a 30-day grace period to make your premium payment for the following month’s coverage. If you fail to make your payment by the end of the grace period, then your coverage for the following month will be terminated on the last day of the grace period. If your coverage is terminated for failure to submit your premium payment in a timely manner, then coverage cannot be reinstated until the next Open Enrollment period (unless you qualify for a special enrollment period).

This website is not inclusive of all situations and is provided for informational purposes only. It is not intended to be an official legal document. If there are conflicts between the website and IRS regulations, the member handbook, or the Summary Plan Description (SPD), IRS regulations, the member handbook, and the SPD will govern.